Discover the very best Currency Exchange Fees for Your International Deals

Elements Impacting Money Exchange Rates

Various economic elements play an essential function in figuring out money exchange rates in the global market. These factors include rates of interest, inflation, political stability, and general economic performance. Rate of interest rates set by reserve banks have a considerable influence on a nation's currency value. Higher rates of interest attract foreign financial investment, increasing the need for that money and triggering it to appreciate. On the other hand, lower rate of interest can result in a decrease in the money's worth.

Inflation additionally plays a crucial role in money exchange rates. Political security is another vital element affecting exchange rates.

Moreover, a nation's financial performance, including indications like GDP growth, profession balance, and work rates, can impact its money value. currency exchange in toronto. Strong financial performance usually brings about a stronger currency, mirroring confidence in the country's economy. Comprehending these financial factors is vital for forecasting and navigating currency exchange rate changes in the international market

Understanding Exchange Rate Calculations

Currency exchange rate estimations are fundamental in figuring out the worth of one money about one more in the worldwide market. These estimations entail complex mathematical formulas that take into consideration different aspects such as supply and need, rates of interest, inflation, and geopolitical stability. The most common method utilized to compute exchange prices is the floating exchange price system, where the value of a money is established by market pressures. In this system, currencies change easily based upon market conditions, without government intervention. An additional technique is the fixed currency exchange rate system, where a country's money is fixed to another currency or a basket of money. This system calls for reserve bank treatment to keep the exchange price within a certain variety. Recognizing these estimations is vital for people and companies included in international transactions, as even little fluctuations in exchange rates can have substantial economic ramifications. By staying informed and keeping track of market trends, stakeholders can make enlightened choices to enhance their currency exchanges and minimize dangers.

Researching Currency Exchange Rate Providers

Carrying out extensive research study on service providers of exchange rates is crucial for individuals and organizations participating in international purchases. The primary step in researching currency exchange rate companies is to recognize respectable resources such as banks, on-line currency converters, and banks. It is essential to contrast the currency exchange rate provided by various companies to make certain competitive rates and transparency in the purchase procedure. Additionally, think about the costs billed by each service provider, as these can dramatically impact the general price of trading currencies.

Take into consideration elements like transaction rate, available money pairs, and consumer support access when selecting an exchange price supplier. By conducting complete study and due persistance, services and individuals can maximize their global purchases and secure the ideal money exchange rates.

Techniques for Protecting Positive Prices

To enhance the end results of international transactions, companies and individuals must strategically align their research findings with reliable methods to safeguarding favorable currency exchange prices. One approach is to monitor the forex market very closely and identify trends that may affect currency exchange rate. By staying notified concerning economic indicators, geopolitical events, and market view, entities can make well-timed decisions to exchange currencies when rates remain in their support. When functioning with an international exchange provider, another reliable approach is to consider using limit orders or stop-loss orders. Limit orders enable individuals to set a specific exchange rate at which they are prepared to make a deal, while stop-loss orders immediately perform a trade once a specific currency exchange rate is gotten to, shielding versus negative market activities. In addition, bargaining with currency exchange service providers for better prices based upon affordable quotes or the volume of the transaction can additionally result in much more beneficial terms. Overall, by combining market recognition, making use of order types, and negotiating purposefully, companies and individuals can boost their possibilities of protecting useful money exchange rates for their global deals (currency exchange in toronto).

Tracking and Taking Full Advantage Of Currency Exchange Rate Opportunities

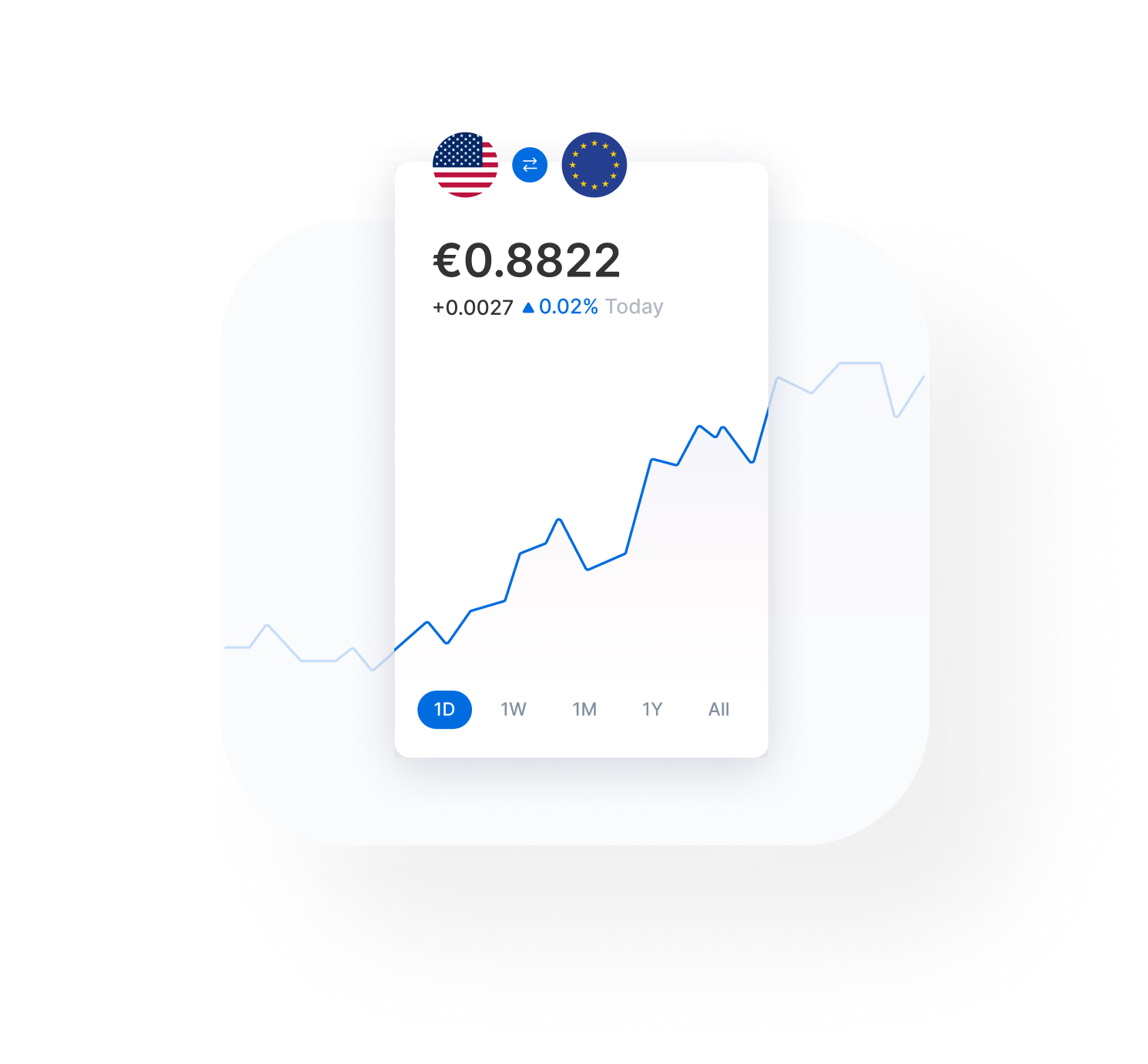

For people and companies taking part in international deals, diligently monitoring currency fluctuations can supply beneficial understandings for making the most of currency exchange rate chances. Maintaining a close eye on the marketplace fads and understanding the factors that influence currency movements is important. Using tools like exchange rate informs and financial schedules can assist in remaining notified regarding prospective shifts. Furthermore, developing a clear currency exchange rate target based on complete research study and analysis can assist in making well-timed transactions to maximize beneficial rates.

Conclusion

To conclude, by considering the factors influencing currency exchange rates, comprehending currency exchange rate estimations, investigating exchange rate service providers, and utilizing approaches to protect favorable rates, individuals can maximize click to investigate their worldwide transactions. Surveillance and making the most of currency exchange rate possibilities will even more boost the efficiency and cost-effectiveness of these transactions. It is essential to stay enlightened and aggressive when handling money exchange rates to make sure the most effective feasible outcomes for your worldwide financial ventures.

In verdict, by taking into consideration the aspects impacting currency exchange prices, comprehending exchange rate calculations, looking into exchange rate suppliers, and using techniques to secure desirable rates, individuals can maximize their worldwide purchases.